[ad_1]

Editor’s note: Seeking Alpha is proud to welcome Nikola Lapenna as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan/Getty Images News

Introduction & Thesis

American Eagle Outfitters, Inc. (NYSE:AEO) is a premier global clothing retailer that offers high-quality and trend-setting clothing, accessories and personal care products online in 81 countries and physically in 26 countries. The company is supported by two key brands: American Eagle; the flagship legacy brand and Aerie, a female-focused colorful and empowerment brand. The AEO stock has significantly underperformed the broader market over the past 12 months, dropping 59% as of April 22, 2022. The company is led by Jay Schottenstein, who has been the chair since 1992 and remains one of the company’s largest shareholders. This analysis explains a bull case for AEO by reviewing their stellar financial performance, forecasting their sales mix, understanding their unique vertical integration strategy, and analyzing their cheap valuation.

AEO Inc. Q4 deck

Background & Operations

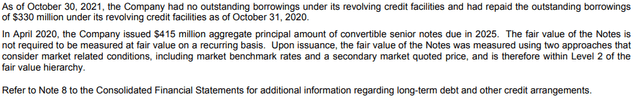

While COVID stymied AEO’s growth plans when governments shuttered malls and stores, a silver lining emerged that has kept pace up until today: a strong online presence. The company has generated 6 straight years of online sales growth, from $0.8B in 2016 to $1.6B last year. While store revenue has bounced back following lockdowns, with a 32% increase in Q4, AEO’s digital revenue continues to flourish, posting all-time high digital sales from both of its brands – American Eagle and Aerie. The company’s sales mix is 70% American Eagle and 30% Aerie, and it achieved all-time high record revenue of $1.5B in Q4. The company is valued at $2.6B as of April 22, 2022 and generated an all-time record $5B in revenue in 2021.

AEO Inc Q4 deck

Unlike competitors, AEO has been prudent with capital and did not take any debt until 2020. Given AEO’s proven growth track record, all-time great 2021 earnings, and low amount of debt, the company remains positioned to generate growth heading to the second half of the year, which is historically a boon for retail.

AEO Inc Q3 SEC filing

Industry Competition

AEO competes in the fast fashion of apparel, with key competitors including Abercrombie & Fitch (ANF), The Gap (GPS), and Urban Outfitters (URBN). The global fast fashion market is anticipated to reach almost $40B in 2025, expanding at a CAGR of 7%. In comparison to their peers, AEO holds three key advantages. The first is stable management; the company has been run by the same leadership for over two decades, and has a culture to promote from within. Given volatile cycles and global supply chain woes, a steady management team with experience is a key intangible. The second advantage is their low amount of debt on the books. AEO historically has had no debt and their recent issuance during the pandemic was a convertible note at a low rate. The third advantage is steady cash flow; the company leases all their stores, so their cash flow and depreciation are easier to manage than competitors. This provides comfort when allocating capital for spending, and ensures a steady dividend payment, which currently yields 4.66%.

Supply Chain Acquisitions & Strategy

Being primarily brand-focused mid-cap apparel retailer, historically AEO has not been a supply chain leader. However, looking ahead into 2022, leadership is focused on supply chain optimization given the long-standing global supply chain crunch. In the past year, AEO bought Quiet Logistics, a fulfillment center leader and Air Terra, a “middle-mile” logistics corporation. AEO spent over $350MM on both acquisitions, but provided a two-pronged strategy for its purpose. The first is reducing customer wait times – improvements have already been reflected through gross margin expansion on digital delivery expense leverage, leading to sped up supply chain lead time of 1.5 weeks. Along with the company’s strong brands, the plan is to emphasize quality and service in its mid-tier pricing segment against its competitors.

Turning Cloud.com

The second part of the strategy, per Shekar Natarajan, Chief Supply Chain Officer, is to create a shared service for the global retail supply chain. His belief is that retail brands that compete for shoppers in clothing shouldn’t also be competing for faster delivery time and raw materials. The AEO team hopes that by providing competitors with superior supply chain service, they can generate more cash, while also keeping better tabs on competitor sales mix.

Risk Profile

When analyzing an apparel brand, there are a few key risks that are important to understand. On a macro level, the risk associated with the company’s inability to anticipate and respond to changing consumer preferences and the risk associated with pricing pressure given high inflation are important. Another key risk is the potential impact from COVID-induced lockdowns. The company is still very reliant on in-store sales, which historically have been 70-75% of sales. The company’s digital sales continue to increase at a 20% CAGR; however, prolonged lockdowns in any of the 26 countries AEO has stores in would negatively impact the company. In 2020, while digital revenue increased $400M, in-store sales decreased $900M.

AEO Q4 Deck

Concerning the company itself, AEO has only two key brands. This varies from competitors, like GPS, who have multiple brands that service different regions globally. The concentration risk of one brand falling out of favor or negative news emerging in regards to the quality or service can be concerning.

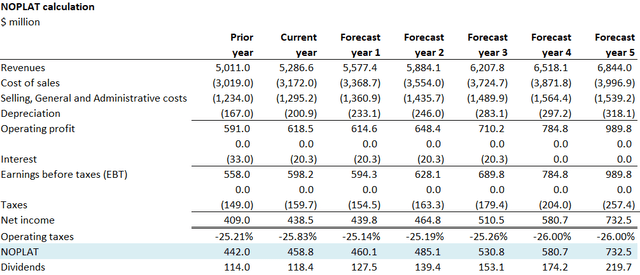

AEO Valuation – Cash Flow Modeling

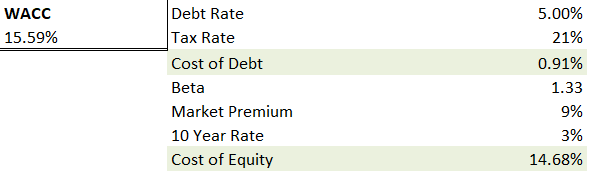

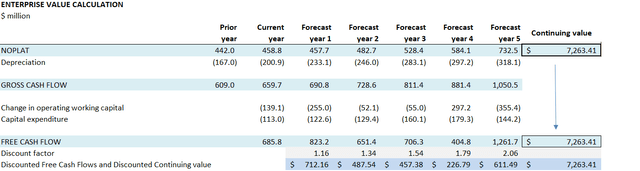

Should AEO deliver on their forecasted growth, its stock price is poised to bounce back. Even with a high market premium, AEO is primed to continue to increase its free cash flow and operate efficiently. Locking in a convertible note at 3.75% turned out to be a smart move in hindsight. Given their strong 2021 performance, their cost of debt shouldn’t dramatically rise above 5% should they attempt to increase leverage in this environment.

WACC

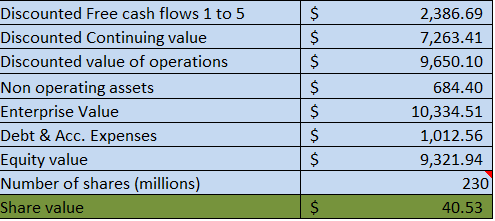

I forecast the terminal value of over $7B, given a 6% revenue increase for three years (similar to historical), before reducing two future years to 5% growth due to concentration of just two brands in a sector that can have consumer preference volatility. I see SG&A expenses falling from 24% to 22% as a percentage of revenue within a 5-year period as synergies from the Quiet Logistics/Air Terra acquisitions start to bear fruit. I hold all other key ratios equal as a percentage of revenue from 2021 figures, as there are not many material differences in 2018 and 2019 figures. As operating profit improves by ~3% over the 5-year term, a $40 share price (see below) can be supported with strong fundamentals and positive sentiment from investors. We assume the convertible note is turned into equity as AEO reinvests in the business – hence the uptick in the number of shares.

5 Year Income Statement

EV calculation

Forecast Share Price Value

Conclusion

AEO is continuing to operate efficiently and has proven resilient over the past two years during the pandemic. Coupled with a supply chain strategy that will elevate both them and their peers, AEO is poised to flourish. Given the discount on shares today, closing near ~$15, I see AEO succeeding over the next 18 months. I anticipate the share price multiple expanding even faster than the company’s earnings, and that the AEO stock will hit a new all-time high of $40/share in the near future.

[ad_2]

Source link

More Stories

Home Lighting Design – Daylighting Design

The Importance of Foam Insulation in Commercial Construction

Importance of Interior Design in Designing Dream Home