[ad_1]

Houston’s supercharged housing market reversed course in June as high mortgage interest rates, rising inflation and a low supply of homes for sale contributed to the biggest drop in single-family home sales in three years.

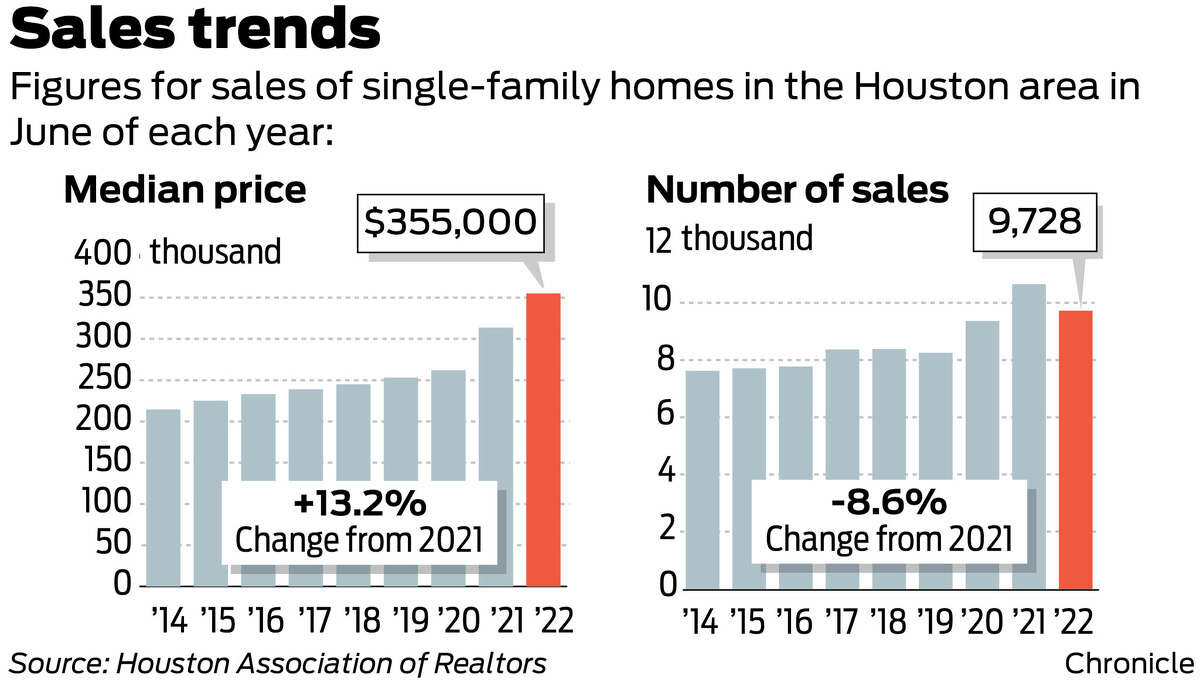

The number of single-family home sales in the Houston area fell by 8.6 percent in June to 9,728 from 10,649 in June of 2021, according to the Houston Association of Realtors’ monthly report. It was the third straight month of year-over-year declines and the biggest since May 2020 when COVID stalled sales.

With a pronounced shortage of homes, particularly those priced below $250,000, prices continued to rise. The median home price reached an all-time high of $355,000, up 13.2 percent from $313,500 in June 2021. The average price, meanwhile, rose 11 percent over the year to $436,425 in June, retreating slightly from May’s record of $439,220.

“With strong economic headwinds facing consumers right now, it comes as no surprise that home sales fell in June and may stay below record levels for a while as the market normalizes,” HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene said in a statement. “The decline in sales was inevitable given the limited supply of homes, record prices, rising interest rates and the pressures of inflation that we’re all feeling every day at the pump, in the supermarket and paying bills.”

The remarkable run-up in home sales, driven by low interest rates and several rounds of government stimulus during the pandemic, started to slow in January, according to Bill Gilmer, director of the C. T. Bauer College of Business Institute for Regional Forecasting at the University of Houston.

Area home sales were 27 percent above pre-pandemic levels in January, on a seasonally adjusted basis, and are now just 2.7 percent above pre-pandemic levels, Gilmer said.

“It’s been a pretty rapid fall back,” Gilmer said. “Sales are coming down from an extraordinarily elevated level.”

Ron Jenkins, a real estate agent with Realm Real Estate Professionals in Katy who sells in the suburbs of southwest and west Houston, has seen a big shift in the market recently.

“A lot of people are retreating, as expected,” Jenkins said. “I’m a little concerned that they’re slowing down so drastically before the end of the summer buying season before school starts.”

Sales trends

Ken Ellis

What’s selling

Ken EllisIn June, most buyers paid above the list price for homes on the market for the third consecutive month, according to HAR.

But Jenkins said that could change. In some markets, such as Katy and Missouri City, he’s seeing price reductions on upward of 20 percent of the listings compared to the previous rate of about 5 percent of listings.

“I see a lot of arrows down,” Jenkins said. “I see homes staying on the market now for at least two weeks as compared to five days or less before.”

Housing dollars are not stretching as far as they did when interest rates were below 3 percent. In addition, inflation, running at more than 10 percent in the Houston area, is cutting into budgets.

Mortgage rates, which peaked at 5.8 percent in June, according to government-sponsored enterprise Freddie Mac, have slipped to 5.3 percent, but remain well above the 2.9 percent a year ago.

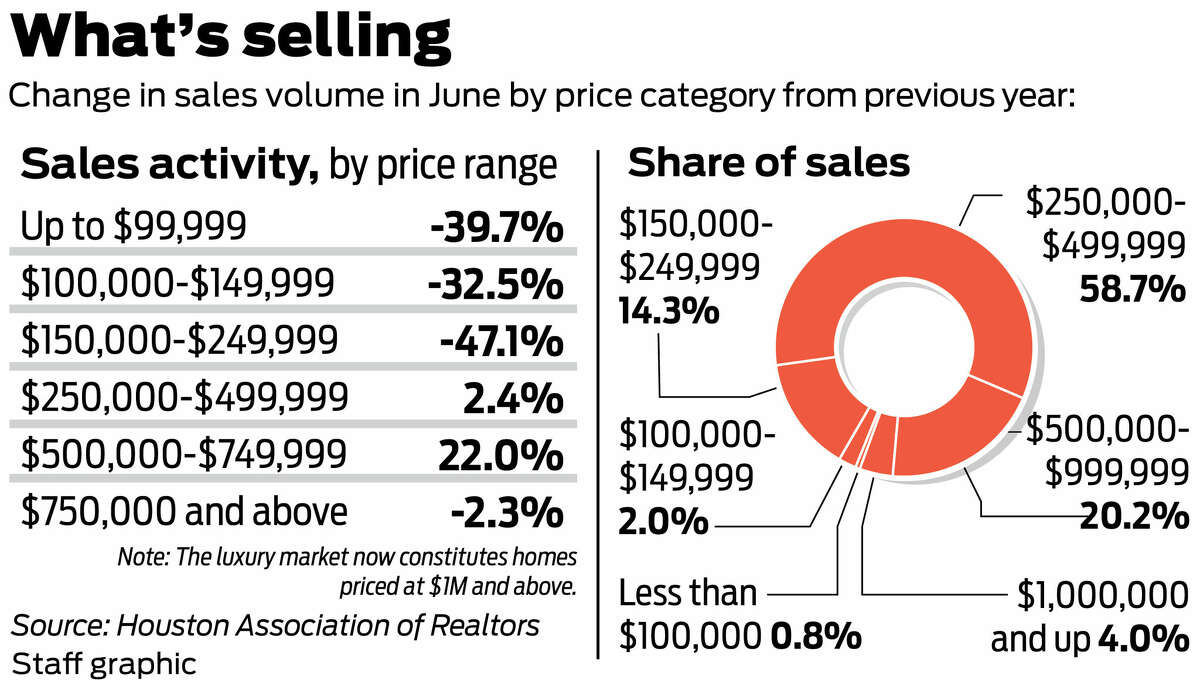

With sales volumes declining or slowing in the more affordable categories, homes in the $500,000 to $1 million price range accounted for 20 percent of the sales in June. The segment drew the highest sales volume in June, rising 22 percent from a year ago. Sales of homes priced from $250,000 to $499,999 rose 2.4 percent. Homes from $150,000 to $249,999 plunged 47.1 percent due to the lack of availability. Luxury homes — those price at $1 million and above — slipped 2.3 percent in their first decline in two years.

Buyers looking for homes under $250,000 had to increase their budgets, shift to rentals or postpone plans to buy, according to HAR.

The slowdown in sales lifted inventory to two months, the highest since Nov. 2020, as new listings hit the market. Inventory, which represents how long it would take to deplete sales at the current pace, was up from 1.5 months in May and 1.4 months in June 2021. Six months is considered a balanced market where buyers and sellers have equal footing. Nationally, inventory stands at 2.6 months.

Single-family listings in the Houston market totaled 18,258 in June, up from 12,648 in June 2021. Pending sales, representing sales that have not yet closed, were down 7.7 percent over the year in June.

While prices have risen rapidly, economists don’t expect them to crash. Homes continued to sell quickly, averaging 28 days in June, a couple of days faster than a year ago, and most buyers are still paying more than the listing price, according to the Houston Association of Realtors. Houston home prices are forecast to go up by a half percent over the next year, according to real estate data firm CoreLogic.

“If you just sort of look at the big sweep of history in Houston and most other places, with the exception of the housing bust in 2008, you tend to see home prices remaining (steady) instead of declining,” Gilmer said. “You’ll just fail to see them go up, more than anything else.”

[ad_2]

Source link

More Stories

Bathroom Renovation in Milton: Transforming Spaces for Modern Living

Explore the Benefits of Office Cleaning Services in Singapore

Expert Tips and Tricks for Effective Removal